- Arecord 27.2% of total federal contracting funds were awarded to small businesses in fiscal 2021, according to just-released data from the Small Business Administration.

- While more dollars ($154.2 billion) and a higher percentage of federal work went to Main Street, a multi-year decline in the total number of small businesses to win government contracts continues.

- In 2010, there were 125,000 small businesses that benefited, but now that’s down to a little over 71,000 firms, and the government continues to fall short on its goals for women and minority businesses.

The federal government awarded $154.2 billion to small businesses in fiscal year 2021, an $8 billion increase from the previous fiscal year, according to data from the Small Business Administration released Tuesday.

That’s a record 27.2% of total federal contracting funds, exceeding the government’s goal of 23%.

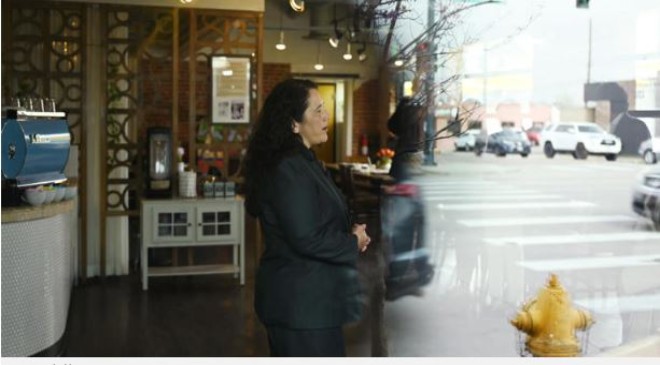

“We are excited to see that more dollars and a larger percentage are going to small businesses,” said SBA Administrator Isabel Guzman, adding that several of the changes President Biden has announced since taking office are starting to take hold. These efforts are aimed at leveling the playing field for small businesses competing for federal contracts, an area where many have struggled.

Still, there’s work to be done. The number of small businesses receiving prime contracts fell again in fiscal 2021, continuing a multi-year trend. The most recent data show that 71,441 small businesses received contracts, down 5.7% from 75,726 in fiscal year 2020.

By contrast, about 125,000 small businesses contracted with the federal government in fiscal year 2010, according to a report by The National Equity Atlas, produced by PolicyLink and the USC Equity Research Institute (ERI) that used SBA data.

Small business advocates cite several reasons for the difficulty small businesses face in procuring government contracts. Part of the problem is due to competition from larger, more established businesses that have more experience, said Shane McCall, equity partner at Koprince McCall Pottroff who works with small businesses. There can also be procedural headaches and statutory requirements that prevent some businesses from applying in the first place, he said.

The federal government’s bonding requirements, in particular, tend to disproportionately impact disadvantaged business enterprises, said Judith Dangerfield, a senior fellow at PolicyLink, a national research and action institute focused on advancing economic and social equity. These business owners must overcome the same bias — the notion that race equals risk — that they face in banking and finance, she said. “As a result, bonding has been a barrier to participation for DBE firms for decades,” she said.

The best federal agencies for small business contracts

Guzman said she is encouraged by the positive developments in the past fiscal year. Notably, 21 of the 24 agencies monitored by the SBA received an “A+” or “A” rating on its scorecard.

The 11 agencies to receive an “A+” grade are: The Department of Commerce, The Department of Homeland Security, The Department of Labor, The Department of State, The Department of the Interior, The Environmental Protection Agency, The General Services Administration, The National Science Foundation, The Nuclear Regulatory Commission, The Office of Personnel Management and The Small Business Administration.

Ten agencies received an “A” grade: The Agency for International Development, The Department of Agriculture, The Department of Defense, The Department of Education, The Department of Energy, The Department of Justice, The Department of Transportation, The Department of Veterans Affairs, The National Aeronautics and Space Administration and the Social Security Administration.

Government goals for women and minority businesses not met

Still, it’s by no means a perfect system, especially for women-owned small businesses and those located in historically underutilized business zones (HUBZones). The women-owned small businesses federal contracting goal has been met just twice since it was established in 1994 and the HUBZone goal has never been met, Goldman Sachs CEO David Solomon wrote in a recent op-ed for CNBC in which he voiced the bank’s support for the first reauthorization by Congress of the SBA in over two decades to provide it with more ability to support small business.

In 2021, women-owned small businesses received $26.2 billion in federal contracts, representing 4.63% of the fiscal year 2021 total eligible dollars, the SBA said. The goal was 5%.

HUBZone small businesses, meanwhile, received a historic $14.3 billion in federal contract awards, translating into 2.53% of the fiscal year 2021 total eligible dollars. It’s the highest level in about 10 years, Guzman said, but still falls short of the government’s 3% statutory goal.

While the agency didn’t meet these goals, Guzman said “they are still on the horizon.”

For women-owned businesses, SBA has increased the number of certified firms to nearly 6,000 from about 1,000. It has also expanded the NAICS codes, the classification system used by the government for business categories, for which women-owned businesses can receive set-aside awards. More than 92% of federal spending is covered by NAICS codes eligible for WOSB (Women Owned Small Businesses) set-aside awards, according to the SBA.

The SBA is also continuing to work on helping HUBZone businesses compete for federal contracts. In 2020, the agency simplified rules to help these businesses compete more effectively. Guzman said the agency aims to do “expanded outreach and make sure more businesses know about the simplified rules.”

Helping small businesses obtain more federal contracts has been a goal of President Biden. Notably, small disadvantaged business spending reached 11% for the first time, according to the new SBA data. The target is to hit 15% of federal contracts by 2025.

White House reforms for Main Street

Late last year, the White House announced key reforms to promote more equitable buying practices. One example is the effort to reform the federal government’s use of “category management,” which has contributed to the consolidation of contracting dollars, said Eliza McCullough, an associate at PolicyLink. The practice allows federal agencies to buy contracts as an organized entity, rather than as thousands of independent buyers. This helps to eliminate redundant buying choices, but an unintended result is that small, disadvantaged businesses receive a proportionally lower share of contracts, she said.

Reforms to mitigate the inequities include giving agencies automatic “credit” under category management for all awards made to small, disadvantaged businesses and strengthening the voice for small business equity considerations in category management governance, McCullough said.

“Along with increased investment in Historically Black Colleges and Universities and other institutions that serve communities of color to uplift the next generation of Black-, Latinx-, and Tribal-owned small businesses, these reforms democratize access to federal contracts and foster inclusive business development,” McCullough said.