The public pension situation could get really messy in the near future.

There are currently about 300 state-administered and nearly 6,000 locally-administered public retirement plans, according to PublicPlansData, a project of the Center for Retirement Research at Boston College and the MissionSquare Research Institute.

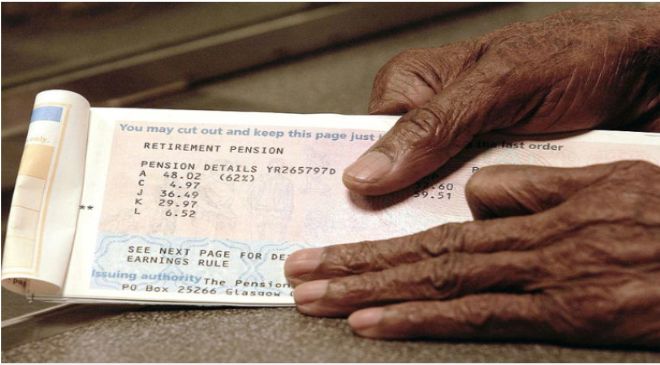

Those public pension systems have 14.7 million workers (e.g., state and local government employees, teachers, police and fire departments) and 11.2 million retirees.

Collectively, those systems had some $4.5 trillion in assets at the end of 2021. After six months of stock and bond market declines, those assets have likely dropped significantly, putting public pension plans in financial stress.

It’s a pattern we’ve seen over and over again. Public pension systems, often pressed by government employee unions, underfund their plans and overpromise their returns. Like a Ponzi scheme, those systems can get by when the markets and the economy are good.

But when the economy and the markets turn south, many of them will face serious shortfalls. That’s when the finger-pointing begins, yet it seems no one is ever willing to take responsibility. Whoever is directing the pension fund will claim the board approved the questionable investments, and the board members will claim they were just following the director’s advice.

In the worst cases, the pension fund will lobby the city or the state, and sometimes the federal government, hoping that taxpayers will bail it out.

Given that frequent pattern, taxpayers should be concerned about a recent article in the Wall Street Journal titled, “Pension funds plunge into riskier bets — just as the markets are struggling.” The article’s subtitle explains why we should be worried: “More public pension plans than ever are using leverage, investing borrowed money in an effort to earn higher returns and close big funding gaps.”

Historically, public pension funds invested very conservatively to minimize risk and ensure they had the funds to meet their retirees’ needs. And while most public pension funds still don’t use leveraged (i.e., borrowed) funds, some of the largest ones are taking that step. The Teacher Retirement System of Texas, the country’s fifth-largest public pension fund, started using leveraged funds in 2019. And the roughly $440 billion California Public Employees’ Retirement System has voted to start next month, according to the Journal.

While leveraging can multiply market gains in the fat years, it can also magnify losses in the lean years. Those down-times tend to drive some public pension funds to take even riskier steps hoping to recoup some of the losses.

It’s like the gambler who’s on a losing streak but keeps betting in the hope of making up some of the losses. If most public pension funds were already underfunded last year, what does that mean today, when the market has been in a six-month slide?

If the market turns around soon, the leveraged bets may pay off. But no one knows if that will happen. Indeed, many economists think we are in for an even bigger stock market crunch if the Federal Reserve Bank stays aggressive on its interest-rate hikes and the economy enters a recession.

If that happens, we will almost certainly see much bigger losses for some public pension funds.

Interestingly, this is a problem faced primarily by the public sector. Private sector companies have increasingly turned to defined-contribution retirement plans. The company, and perhaps the employee, puts money in a retirement account that belongs to the employee. Once the company has made its contribution, its financial obligation is over.

Most public pensions are still heavily reliant on defined-benefit plans, where the employer promises some level of benefits when the employee retires. Unions tend to favor defined-benefit plans, perhaps because it’s easier to commit fraud and not get caught or punished.

Edward Siedle, a former U.S. Securities and Exchange Commission (SEC) attorney and a Forbes contributor, explained the problem in 2021 in an opinion piece titled, “Public pension looters need not fear FBI and law enforcement.” He highlights an SEC investigation into allegations of fraud and corruption at Pennsylvania’s $70 billion public school pension plan.

Of course, some of the private sector’s best money managers have been losing money in this market. But they won’t be able to go to the government and get a taxpayer bailout. If public pensions find themselves severely underfunded, whether because of a down market or bad, even ludicrously risky, investment decisions, or both, that’s exactly what they will do.