There’s more evidence that the economic narrative could be undergoing a major shift.

For months, we’ve been living in an economy in which strong demand has been met with lagging supply, causing inflation inflation to surge. We now appear to be shifting to a phase where demand growth is cooling and supply chains are easing, which should cause inflation to come down.

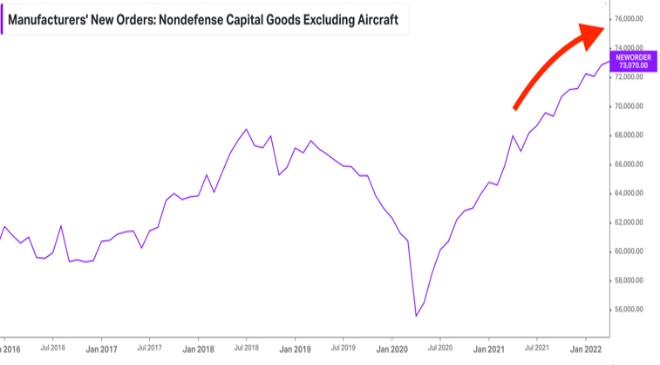

According to Census Bureau data released Wednesday, orders for nondefense capital goods excluding aircraft — a.k.a. core capex or business investment — climbed 0.3% to a record $73.1 billion in April.

While the 0.3% growth rate represents a deceleration from the 1.1% rate in March, it’s the kind of slowing that’s welcome news for folks like the Federal Reserve, which is actively working to cool economic growth in its effort to bring down inflation.

“That is consistent with our view that economic activity is bending rather than breaking under the impact of higher rates,” Michael Pearce, senior U.S. economist for Capital Economics, said in a note on Wednesday.

Core capex growth represents a massive economic tailwind. And the fact that it continues to grow, albeit at a decelerating pace, is a good sign for economy-wide growth.

According to S&P Global Flash US Manufacturing PMI report released on Wednesday, these emerging economic trends have continued into May. Specifically, the composite output index fell to a four-month low of 53.8 in May. For this index, any reading above 50 signals growth, and so the declining number suggests growth is decelerating.

“Growth has slowed since peaking in March, most notably in the service sector, as pent up demand following the reopening of the economy after the Omicron wave shows signs of waning,” Chris Williamson, chief business economist at S&P Global Market Intelligence, wrote on Wednesday.

Consumer spending growth cools as excess savings get tapped

Growth appears to be cooling on the consumer front too.

According to a BEA report released Friday, personal consumption expenditures (i.e., consumer spending) increased by 0.9% in April from the prior month to new record levels. However, this was a healthy deceleration from March’s 1.4% growth rate.

The spending came as the saving rate (i.e., the difference between income and spending) fell to its lowest level since September 2008.

While this development on its own is unsettling, it comes after consumers spent over two years accumulating over $2 trillion in excess savings.

“It looks like households have been eating into the ‘excess saving’ that was built up at earlier stages of the pandemic in order to fuel consumer spending in recent months,” Daniel Silver, economist at JPMorgan, wrote in a note on Friday.

As we’ve discussed frequently on TKer, these excess savings represent a massive economic tailwind. For a while, you could argue that it was exacerbating inflation. But now it appears to be bolstering spending as the economy slows.

News of a slowdown is not exactly the kind of thing that warrants a celebratory tone. But it’s exactly the kind of thing that should help bring inflation down.

More signs that supply chains are easing

S&P’s PMI report also suggested there could be some daylight in the disrupted supply chains.

“Manufacturers in particular also report that capacity continues to be constrained by supply shortages, though these bottlenecks showed further encouraging signs of easing,“ S&P’s Williamson said (emphasis added).

It’s also been a while since we’ve heard about ships idling outside of ports waiting to be unloaded.

“U.S. port data suggest easing backlogs,” JPMorgan economists wrote last week. “Notable examples are the ports of Los Angeles and Long Beach, which process about 40% of total imports into the US.”

And it’s not just ocean freight that’s loosened. Trucking freight seems to be loosening too.

According to BofA’s Truck Shipper Survey for the week ending May 19, “shippers find it much easier to secure capacity (its highest level since June 2020).“© Provided by Yahoo Finance USMore signs that a major shift in the economic narrative could be underway

Unfortunately, at least some of these signs of loosening supply chains can be explained by easing demand for goods. But again, this is the dynamic that should make for easing inflation.

More signs that the labor market is cooling

Bloomberg reported that tech behemoth Microsoft was slowing hiring in its Windows, Office, and Teams businesses.

PayPal laid off 83 employees at its headquarters in San Jose.

These are anecdotes. But the developments are in line with the Fed’s aim of cooling inflation by first cooling the labor market.

Subscribe now

Signs that inflation peaked

Last month, I wrote about how economists across the board were saying that inflation — as measured by year-over-year increases in prices — had peaked.

On Friday, we got more evidence to confirm that may be the case.

The core PCE price index — the Fed’s preferred measure of inflation — climbed 4.9% in April from a year ago. This is down from the 5.2% rate in March and the 5.3% peak rate in February.

On a month-over-month basis, the core PCE price index has climbed by a cool 0.3% over the past three months.

It’s still too early to claim victory on inflation

“Many have touted March as the peak in inflation and are looking for inflation to cool from here,” Grant Thornton Chief Economist Diane Swonk said on Friday.. “We are not as convinced given the risks we still face due to the war in Ukraine and lockdowns in China. Either way, it is important to note that any cooling we see will have a high floor. Both the overall and core PCE indices remain well above the Federal Reserve’s 2% target.”

Indeed, inflation has a long way to go to get to 2% from 4.9%.