The commercial real estate market is tumbling toward a crash that could be as devastating as the 2008-09 crisis, according to the CEO of a major real estate investment firm.

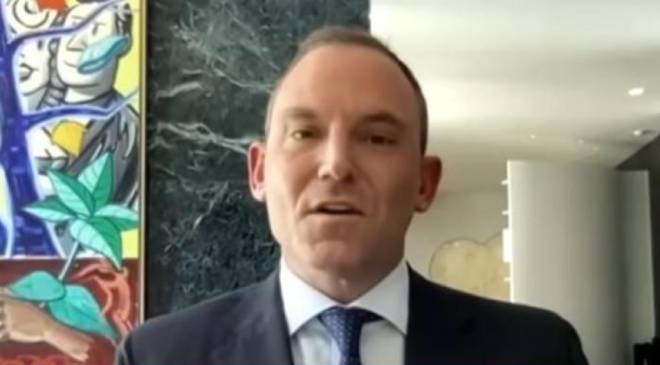

Patrick Carroll, founder and CEO of CARROLL, sounded the alarm about the state of the U.S. commercial real estate market in an April 2023 interview with CNBC.

Read More:- Morgan Stanley credits ‘Bidenomics’ in lifting its U.S. economic-growth outlook

“The party’s over, unfortunately,” he said. “The office market’s going to be destroyed, hotels are going to be destroyed — it’s going to be ugly.”

A dire warning for commercial real estate

Carroll is not the first — and certainly won’t be the last — to ring the warning bell for the commercial real estate sector.

Since the collapse of Silicon Valley Bank in March, experts have raised concerns about the mega $1.5 trillion wall of debt looming for U.S. commercial properties.

That mortgage debt — which is held mostly by small- and medium-sized banks — comes due for repayment before the end of 2025.

“No lender is willing to lend because they don’t know where interest rates are going,” Carroll said.

Real estate safe haven?

According to Carroll, there is one real estate niche that is riding out this wave: multi-family real estate.

In contrast to commercial real estate, the multi-family market has “strong fundamentals,” says Carroll, whose real estate investment firm manages more than 33,000 multi-family units across nine states.

Read More:- SNAP benefits: Who will receive payments on July 23?

“I talked to one of the biggest landlords in the world yesterday and what he’s telling everybody is: ‘Stay alive ‘til ‘25.’ Right now, our fundamentals are great, people are paying rents [and] the market is healthy,” he said.

First National Realty Partners* makes it easy for accredited investors to grow their returns through multi-family real estate, along with related opportunities in grocery-anchored, necessity-based retail space.

With FNRP, accredited investors can collect quarterly cash flow through a diverse real estate portfolio. FNRP’s team of experts manages every component of the investment life cycle for you and – using proprietary technology – vets each deal against a rigorous set of investment criteria. Management is also in-house,giving you peace of mind as you enjoy your distributions.

Here are other ways to strengthen your portfolio:

Diversify your assets

By strategically growing your portfolio with a variety of assets, you’re better equipped to balance risk and reward.

Masterworks* is one option that gives high net worth investors easy access to renowned works of art through fractional shares.

Read More:- 8 Steps to Making $500 From Thrifting

Using Masterworks’ online platform*, you can invest in fine art without the legwork of attending auctions – or even being an art connoisseur yourself.

If you’ve got a taste for the finer things in life, you’re in luck. Not only is fine art proven to enhance portfolio performance, but fine wine is too.

Vinovest* provides the chance to invest in this inflation-resistant, sip-worthy asset.

All you have to do is answer a few quick questions about your investment goals and risk tolerance and fund your account. Vinovest’s master sommeliers will then use proprietary algorithms to set up your portfolio.

From there, you can sit back, relax, and enjoy steady yield on this alternative investment.*

Explore new investment opportunities

If your portfolio needs some bulking, seeking out new investment opportunities can offer some strength. And you don’t need to be ultra-wealthy to get in on unique assets.

Yieldstreet* — an alternative investing marketplace — makes private investing opportunities accessible to retail investors.

Read More:-Direct deposits not showing up in some Wells Fargo customer accounts, here’s why

With offerings in transportation, real estate, legal finance, crypto and more, you can invest in private investments that have been professionally vetted* and typically have low stock-market correlation.

Yieldstreet offers term flexibility and a wide range of accessible minimums, and their dedicated support team is available to help you at any time.