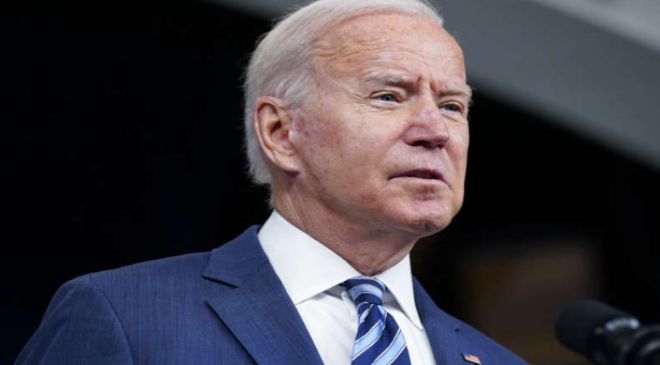

WASHINGTON — President Joe Biden is set to announce Wednesday that he will forgive $10,000 in student loan debt for millions of borrowers who fall below an income cap, according to sources familiar with the plan.

After weighing executive action for months, the president is expected to reveal his long-awaited decision after he returns to the White House from vacation in Rehoboth Beach, Delaware. The action is also expected to include extending until January a pause on federal student loan payments – implemented during the coronavirus pandemic – set to expire at the end of this month.

The White House would not confirm the upcoming announcement, first reported by the Associated Press.

The president has said he would make a decision by Aug. 31. Biden faces increasing pressure from progressive Democrats to cancel an even larger share of debt for Americans who took federal loans to pay for college. But some Democratic economists, including former Treasury Secretary Larry Summers, worry about the risk of debt cancelation exacerbating 40-year-high inflation.

What the president is considering

- The White House has zeroed in on a plan that would cancel $10,000 in student loan debt per eligible borrower, according to sources, matching a figure Biden campaigned on. The White House has also discussed expanding relief beyond $10,000 for borrowers who meet certain criteria, according to one source.

- The debt cancellation would be limited to borrowers with family incomes of $125,000 or less, and would apply only to people with federal loans, not private ones.

- More than 43 million people have federal student loan debt in the U.S., and the average borrower has about $37,000, according to data compiled by the Education Data Initiative. The outstanding federal loan balance is about $1.6 trillion.

Progressive Democrats have pushed for more

- Canceling $10,000 in student loan debt could receive mixed reviews from progressives groups – including the NAACP, Congressional Black Caucus and unions – that have sought greater debt forgiveness. Some liberals have urged Biden to cancel all student loan debt. Top Democrats, including Majority Leader Chuck Schumer, D-N.Y., and Sen. Elizabeth Warren, D-Mass., lobbied Biden to cancel at least $50,000 in student loan debt.

- “If the rumors are true, we’ve got a problem. And tragically, we’ve experienced this so many times before,” said Derrick Johnson, president and CEO of the NAACP, which has pushed for a minimum student debt cancelation of $50,000.

- The income cap for eligibility – designed to prevent wealthy Americans from benefiting – is another area of contention for progressive activists, who say it would create a bureaucratic mess and prevent millions of borrowers from getting relief.

- “The hoops of means testing means that millions and millions of borrowers won’t get help,” said Melissa Bryne, executive director of We The 45 Million, which represents student loan borrowers advocating for student debt cancelation. She called it “an outrageous violation” of Biden’s campaign pledge to cancel student loan debt to all borrowers.

Inflation risk hangs over decision

- Biden said in April that he was taking a “hard look” at executive action to forgive federal student loan debt. Chief among the White House’s considerations in the months that followed: the possible impact on inflation that has soared throughout the year.

- Canceling potentially up to $10,000 in student loan debt would mean billions more collectively staying in the pockets of Americans. Some critics argue the extra money for consumers to spend risks stoking demand and further accelerating historic inflation.

- Summers, former Treasury secretary in the Clinton administration and economic adviser to Barack Obama, has led the warnings about the impact on inflation and said canceling student debt would disproportionately help higher-earning Americans. Jason Furman, Obama’s chair of the Council of Economic Advisers, has raised similar concerns.

- “Student loan debt relief is spending that raises demand and increases inflation,” Summers said in a tweet Monday. “It consumes resources that could be better used helping those who did not, for whatever reason, have the chance to attend college. It will also tend to be inflationary by raising tuitions.”

The impact for borrowers

- A study from Liberty Street Economics found forgiving $10,000 per borrower would wipe $321 billion in student loan debt, and it would completely erase the debt for about a third of borrowers, or roughly 12 million people.

- A separate study this week from the The Wharton School of the University of Pennsylvania found that forgiving $10,000 in federal college student loan debt will cost the federal government between $300 billion and $980 billion over 10 years.

- The Biden administration has already has erased roughly $32 billion in student debt for 1.6 million borrowers by widening the eligibility requirements for pre-existing relief programs, such as the Public Service Loan Forgiveness program.

A boost for Democrats in the midterms?

Canceling some student loan debt – an idea wildly popular among young voters who lean to the left – could energize a key voting bloc that has shown signs of being unenthused in the November midterm elections.

A USA TODAY/Public Agenda poll in July found that nearly 60% of Americans support “forgiving a significant portion of government student loans for college graduates who have excessive debt.” That rate of support dropped when Americans were asked about forgiving debt for all graduates, regardless of income.

Previewing their line of attack, Republicans have slammed student debt cancelation as a ploy to reward the liberal, college-going elite and punish those who couldn’t afford college or had to save to pay off their debt. They also said it would spike inflation.

“Joe Biden has had a lot of bad ideas,” Sen. Tom Cotton, R-Ark., said Tuesday. “But transferring billions in student loan debt to taxpayers – especially at a time of high inflation – might be his worst idea yet.”