The average one-year price target for Niu Technologies – ADR (NASDAQ:NIU) has been revised to 5.80 / share. This is an decrease of 13.12% from the prior estimate of 6.68 dated June 1, 2023.

The price target is an average of many targets provided by analysts. The latest targets range from a low of 4.14 to a high of 7.77 / share. The average price target represents an increase of 30.91% from the latest reported closing price of 4.43 / share.

Also Read- NPR hit with massive layoffs, cancels 4 podcasts

What is the Fund Sentiment?

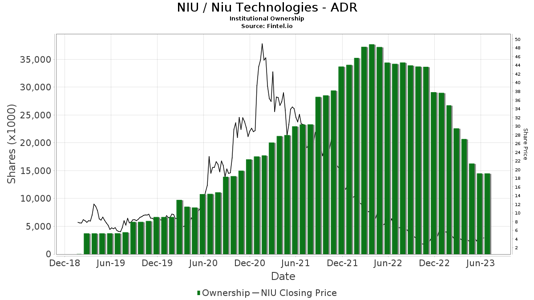

There are 118 funds or institutions reporting positions in Niu Technologies – ADR. This is a decrease of 13 owner(s) or 9.92% in the last quarter. Average portfolio weight of all funds dedicated to NIU is 0.08%, an increase of 9.58%. Total shares owned by institutions decreased in the last three months by 29.88% to 14,499K shares.

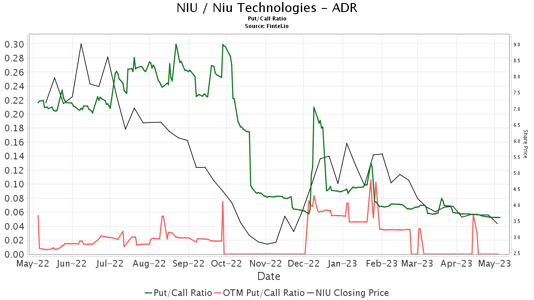

The put/call ratio of NIU is 0.04, indicating a bullish outlook.

What are Other Shareholders Doing?

Also Read- 20 years later, Iraq War veteran fights for Army to recognize PTSD claim

Deutsche Bank Ag\ holds 1,229K shares representing 1.59% ownership of the company. In it’s prior filing, the firm reported owning 1,059K shares, representing an increase of 13.86%. The firm decreased its portfolio allocation in NIU by 89.15% over the last quarter.

Yiheng Capital Management holds 1,163K shares representing 1.51% ownership of the company. No change in the last quarter.

Sumitomo Mitsui Trust Holdings holds 1,069K shares representing 1.39% ownership of the company. In it’s prior filing, the firm reported owning 3,378K shares, representing a decrease of 216.04%. The firm decreased its portfolio allocation in NIU by 76.43% over the last quarter.

Nikko Asset Management Americas holds 1,069K shares representing 1.39% ownership of the company. In it’s prior filing, the firm reported owning 3,378K shares, representing a decrease of 216.04%. The firm decreased its portfolio allocation in NIU by 80.45% over the last quarter.

Jpmorgan Chase holds 1,033K shares representing 1.34% ownership of the company. In it’s prior filing, the firm reported owning 605K shares, representing an increase of 41.40%. The firm increased its portfolio allocation in NIU by 24.84% over the last quarter.

Also Read– Rupert Murdoch, 92, announces engagement to Ann Lesley Smith

Niu Technologies Background Information

As the world’s leading provider of smart urban mobility solutions, NIU Technologies designs, manufactures and sells high-performance electric bicycles and motorcycles. NIU has a product portfolio consisting of seven series, four e-scooter series, including NQi, MQi and UQi with smart functions and Gova, two urban commuter electric motorcycles series RQi and TQi, and a performance bicycle series, NIU Aero. Different series of products address the needs of different segments of modern urban residents and resolve the demands of different scenarios of urban travel, while being united through a common design language that emphasizes style, freedom and technology. NIU has adopted an omnichannel retail model, integrating the offline and online channels, to offer the products and services.