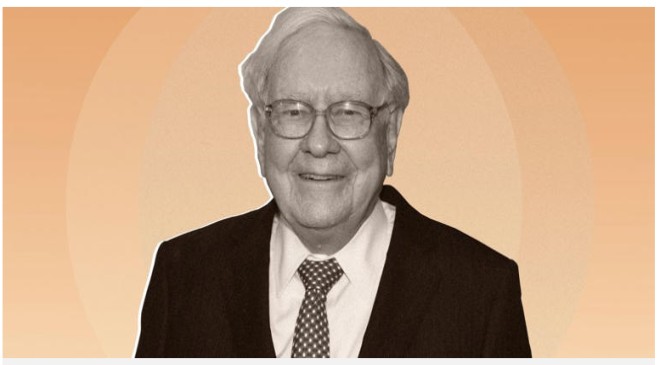

Currently sitting eighth Forbes’ Real-Time Billionaires list with a net worth of $133.4 billion, Warren Buffett is a sterling example of an investor who stuck to his core financial beliefs early on to become a monumental success in the financial world later in life.

Read More : The Key Differences Between A Passport Card & A Passport Book

According to bestselling author Morgan Housel (“The Psychology of Money”), the 93-year-old Berkshire Hathaway co-founder, chairman and CEO earned 99% of his wealth after the age of 65. “If Buffett retired at age 65, you would have never heard of him,” said Housel during a 2022 interview with CNBC.

Although he is notoriously frugal and thoroughly researches and practices value investing by buying up strong brand stock when its selling at less than their intrinsic value, Buffett’s billions grew because he started investing early and held on to stock for the long-term, allowing compound interest to do its thing through the years. “His skill is investing, but his secret is time,” Housel said.

Start Early and Stay Focused

Read More : Federal Judge Suspends Joe Biden’s Plan to Slash Credit Card Late Fees to $8

Most people couldn’t have been as financially prescient as Buffett was as a young man. For goodness sake, at the age when the vast majority of Americans are starting to hit puberty, Buffett was hitting the stock market, making his first investment at 11.

Although Buffett is an anomaly, compound interest encourages and rewards individuals to start investing early to maximize growth over many years. “It’s actually pretty easy to become a millionaire if you’re starting early,” Bradley Klontz, a certified financial planner and behavioral finance expert with Your Mental Wealth Advisors, told CNBC.

Compounding increases the value of the money you have invested by reinvesting interest back into the principal, allowing it to generate even more earnings. Your principal will grow faster the more frequently interest is compounded, but it needs time to grow.

According to Klontz, it’s crucial to resist following popular investment behavior by trying to time the market. Many get nervous and start to sell when the market dips, which is the opposite of what you should be doing. Trusting market returns over time and sticking to your investment goals will prevent an itchy trigger finger and, inevitably, capital losses.

Regardless of age, it’s easier to withstand the temptation to spend now when you have a focused financial strategy and future wealth target in mind. By diligently contributing regular, automated amounts to your preferred investment, like a 401(k) retirement plan or a low-cost S&P 500 index fund, you won’t reach Buffett’s net worth, but you’ll reap rewards through your patience.