It doesn’t take much money to get a lot out of investing. Give the stock market enough time, and compounding will take good care of you. But what if you had just $500 to kick-start your investing portfolio?

An index fund — designed to track a specific market index — would be an excellent choice to start. These funds are buckets of individual stocks lumped together and traded under one ticker symbol.

Read More:- 1 Warren Buffett Stock That Could Go Parabolic in 2024

The Vanguard S&P 500 ETF (NYSEMKT: VOO) tracks, you guessed it, the S&P 500.

Here are three reasons investors should put at least their first $500 into this rock-solid index fund.

1. It’s a Warren Buffett pick

Warren Buffett is known for his legendary career as a stock picker and CEO of Berkshire Hathaway. Within Berkshire, he has a massive $365 billion stock portfolio with dozens of companies.

With all his immense investing talent, Buffett keeps just two index funds in his portfolio. Both happen to track the S&P 500, which isn’t a coincidence.

According to Buffett, owning an S&P 500 index fund is the best thing most investors can do, as he said at Berkshire’s 2020 annual shareholder meeting. One of the two index funds in Berkshire’s portfolio is the Vanguard S&P 500 ETF.

2. It tracks the world’s best index

Buffett’s fascination with the S&P 500 is well justified. The index itself represents about 500 of America’s most prominent corporations.

Read More : What Is Fintech? Here Are 5 Examples and Their Benefits

The U.S. is the world’s largest economy, so getting into the S&P 500 is a badge of honor that puts a company among the world’s best businesses. It’s hard to argue against the wealth our capitalist system has created.

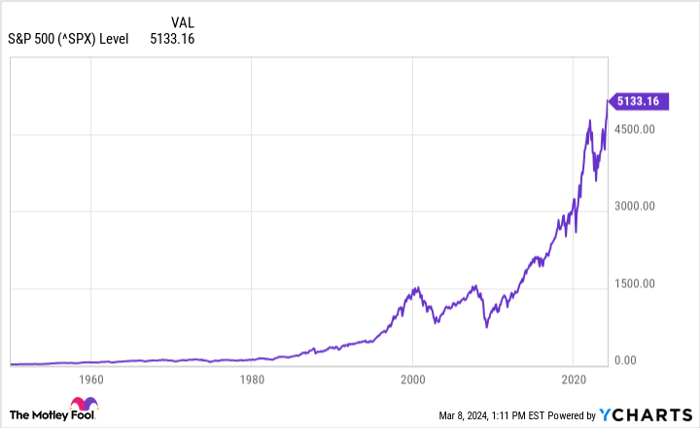

The market can become volatile as a reflection of how buyers and sellers feel at any given time, but over the long term, the S&P 500 has always bounced back and risen to new highs. That remains true today, with the index now at all-time highs:

Read More:- 2 No-Brainer Stocks to Buy Right Now for Less Than $20

The Vanguard S&P 500 ETF hitches your wagon to this financial horse, and for practically nothing in return. All funds charge an expense ratio to compensate those running the fund, but this fund’s expense ratio is just 0.03%, or less than $0.02 on your $500 investment.

Read More : 3 Reliable Dividend Stocks With Yields Above 9% You Can Buy With Less Than $100 Right Now

3. It provides instant diversification

Perhaps the best part of a fund like the Vanguard S&P 500 ETF is its diversification. It’s hard to buy many shares of stock with $500, but buy one share of this fund, and you’re instantly exposed to every company in the S&P 500. That means you own a tiny piece of all the “Magnificent Seven” stocks and hundreds more!

It might be tempting to buy one stock with $500, but what if something happens to that one company? The S&P 500 has proved to be resilient since its founding, and barring a doomsday economic scenario, it will still be here 10, 20, or 50 years from now.

And your money will be working for you all that time. You won’t find a better use for $500 than buying a fund like the Vanguard S&P 500 ETF.

Before you buy stock in Vanguard S&P 500 ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard S&P 500 ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Read More : Is Ordinary Angels on Amazon after theaters? (Where to stream)

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than tripled the return of S&P 500 since 2002*.