Investors have been dealing with major volatility over the past two years, but there are still great growth stocks available in the market. The retreat from COVID-era highs has created a buying opportunity for long-term investors. These three stocks might have some short-term issues to overcome, but they have long-term catalysts that could lift them above the market as a whole.

Read More:- If the S&P 500 breaks this key support level, bulls will be in trouble

1. Splunk

Splunk (NASDAQ: SPLK) offers a data platform that provides a number of benefits to enterprises, such as analytics functions, observability, application monitoring, security, and automation. The platform ultimately allows customers to enhance the value of their own data and technology, and it’s clear why that would be in high demand.

Industry catalysts are important for growth stocks, but competitive position and product quality are just as crucial. Splunk gets high marks across its portfolio from numerous software ratings outlets. That assessment is corroborated by the company’s excellent net dollar retention rate on cloud subscriptions, which has been above 120% in recent years.

This metric indicates that subscribers who were active one year ago are generating 20% more revenue now. That suggests excellent customer satisfaction, effective upselling strategies, and ongoing development of valuable product enhancements.

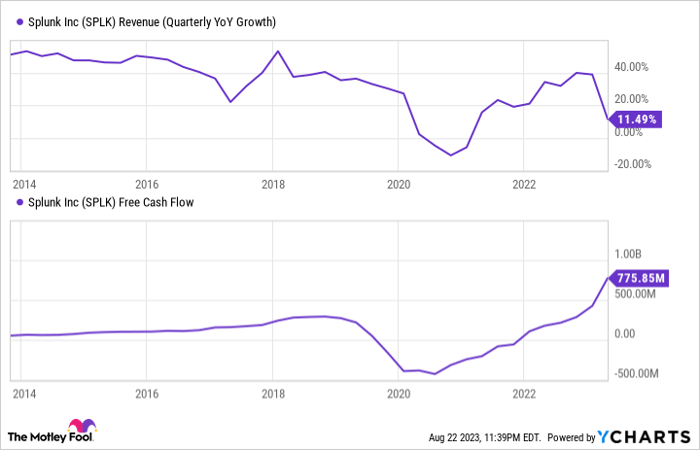

Splunk has experienced macroeconomic challenges in recent years. While its revenue continues to expand at an impressive pace, the rate of expansion has been falling. In response to these challenges, Splunk’s management team has wisely turned its focus to profitability. This has resulted in excellent free-cash-flow generation.

Read More:- ASE Technology And Its Real Value

Recent financial results reveal a bullish trend moving forward. Splunk reported 16% growth in annual recurring revenue last quarter. That was achieved despite the company cutting operating expenses. The company has achieved significant operating leverage, which means that it can continue to scale up its revenue without adding proportionately more expenses. That’s a path to sustainable profitability and strong cash-flow generation, and Splunk has proven its capability on this front.

Read More – Europe’s power is fading fast

The stock’s forward P/E ratio is over 30. That’s a fairly attractive valuation for growth stocks, but it’s aligned with Splunk’s projected growth for the next few years. Splunk already has fairly high saturation in its addressable market with roughly 90% of Fortune 100 companies already deploying its platform.

This might prevent the company from attaining exceptionally high growth rates moving forward, but there is still plenty of opportunity to launch new products and expand relationships with existing customers. If the company returns to rapid growth when economic conditions improve, there’s opportunity for meaningful appreciation here.

2. CrowdStrike

CrowdStrike (NASDAQ: CRWD) is a cybersecurity stock that specializes in cloud and endpoint security. Its products help with threat protection, detection, and management, making it a valuable tool for any business that maintains a network. Its product suite is considered a leader by a number of high-profile analysts, helping CrowdStrike stand out in a marketplace with several strong competitors.

CrowdStrike rode that strong demand to extremely high revenue growth rates, which have been difficult to maintain as it scales. Difficult economic conditions have created an additional challenge, causing the growth rate to trend steadily downward.

Read More:- U.S. stocks open higher, with the S&P 500 extending gains this week

While growth investors don’t want to see that trend, CrowdStrike’s rate of expansion is still exceptional at more than 40% in its fiscal 2024 first quarter. Meanwhile, the company has achieved higher free cash flow after focusing on expense controls. After exceeding expectations in its most recent quarter, the company revised its full-year forecasts higher.

CrowdStrike’s forward P/E ratio is above 60, but that’s fairly reasonable relative to its current growth rate. It’s also much cheaper compared to historical levels — the stock has dropped 50% from its all-time high while the underlying business continues to grow. That move lower can be attributed primarily to interest rates and macroeconomic conditions, and it allows growth investors to buy a quality stock for a more reasonable valuation.

3. Fortinet

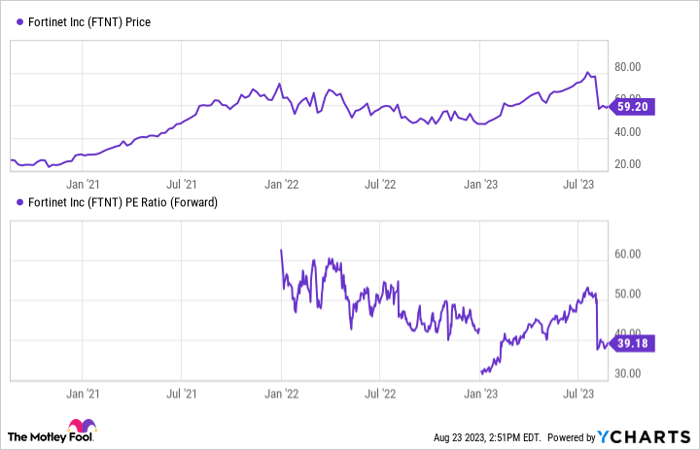

Fortinet (NASDAQ: FTNT) is another leading cybersecurity stock, but this company specializes in firewall services. It also offers endpoint security, networking, and other related products. The stock suffered huge sell-off earlier this month after a disappointing earnings result — shares dropped nearly 25% and its forward P/E ratio dropped from over 50 to under 40.

Investors were discouraged by revenue growth that slowed to 26% over the prior year. The company also revised its full-year outlook downward based on macroeconomic pressures, compounding concerns. Growth investors usually shouldn’t be excited by slowing growth, but this sell-off could have created a long-term opportunity if the headwinds are truly temporary.

Read More:- If You Invested $1,000 In Coca-Cola Stock When Warren Buffett Did, Here’s How Much You’d Have Today

Many enterprise software businesses have struggled this year. High interest rates and slowing economic growth are causing enterprises to delay or outright cancel many planned investments, and that’s trickling down to vendors like Fortinet. Despite recent struggles, Fortinet is still considered an industry leader by Gartner. With a wide economic moat, demand for its product suite is likely to remain strong, and Fortinet’s operational and product strength should position it to take advantage of that macro trend.

Even if billings are challenged right now, the long-term catalysts are still clear. Fortinet is still growing more than 25% annually with an opportunity for that to accelerate when the global economy rebounds. The company is producing significant cash flows, and it’s now available at a reasonable PEG ratio just under 2.

10 stocks we like better than CrowdStrike

Read More:- Stock market today: Asian stocks mixed as traders await Fed conference for interest rate update

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and CrowdStrike wasn’t one of them! That’s right — they think these 10 stocks are even better buys.