il and natural gas are not boring stocks and investors would do well to expect regular dramatic and swift price moves. There’s not much investors can do about that; it’s basically built into the commodity-driven sector.

What you can control is how you deal with the inherent volatility of energy prices. That means carefully considering what stocks you own. Here are some ways to think about energy investing so you know what you are getting into before the next big move in the sector gives you a fright.

Read More:- Edmunds Rates These 6 New Cars the Best in 2023

There are lots of options

The energy sector is broadly broken down into three segments: upstream (energy production), midstream (pipelines), and downstream (refining and chemicals). All three have different dynamics, but the upstream and downstream are both highly volatile with supply and demand and commodity prices driving revenue and profits. This is why conservative investors might want to start their energy search in the midstream.

Midstream stocks, like Kinder Morgan, Enbridge, and master limited partnership Enterprise Products Partners (NYSE: EPD), all help to move oil from where it is produced to where it gets processed and eventually consumed. The assets these entities own are large, vital, and — in most cases — would be difficult to replace.

Demand for the services provided by these companies tends to remain strong even when energy prices are weak. The key here is that these companies generally charge fees for the use of their assets. That generates fairly reliable cash flows that then get pushed out to investors in the form of sizable dividends.

For example, Kinder Morgan’s dividend yield is 6.9%, Enbridge’s is 7.1%, and Enterprise’s distribution yield is 7.5%. All three have strong coverage of their disbursements, though the cash that investors collect from dividends is likely to represent the lion’s share of returns given the nature of the midstream sector.

But for investors seeking energy exposure while trying to minimize commodity price risk, the midstream is the place to be.

Boring or exciting

If, however, you are comfortable with some commodity exposure, the next stop should be with an integrated energy giant like ExxonMobil (NYSE: XOM) or Chevron (NYSE: CVX). These companies, and their peers, have exposure to all segments of the energy process, from the upstream to the downstream.

This doesn’t protect them from volatile energy prices, but it does tend to soften the peaks and valleys, since the downstream tends to benefit when oil prices are low (oil is a key input for chemicals and refining) and vice versa at the other end.

Global portfolios also help these companies operate in the most advantageous areas — for example, by drilling in regions with low production costs and selling into those with high energy demand.

Also Read– Why Keeping All of Your Retirement Savings in an IRA Is a Really Bad Idea

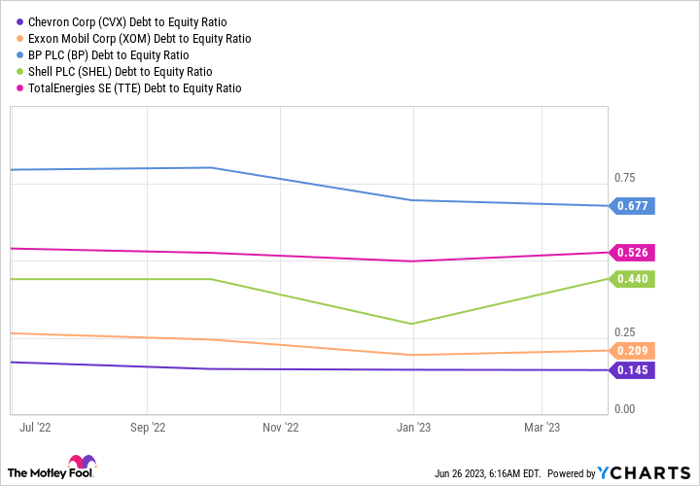

In addition, integrated energy companies are often very strong financially. That’s particularly true of ExxonMobil and Chevron, which have the strongest balance sheets among their closest peers. This has provided both of these companies the leeway to use debt during weak markets to continue to invest in their businesses and pay dividends.

ExxonMobil has increased its dividend for 41 consecutive years, while Chevron’s streak is at 36 years. That’s pretty impressive for companies that operate in a cyclical industry. Their yields are 3.5% and 4%, respectively.

The most volatile

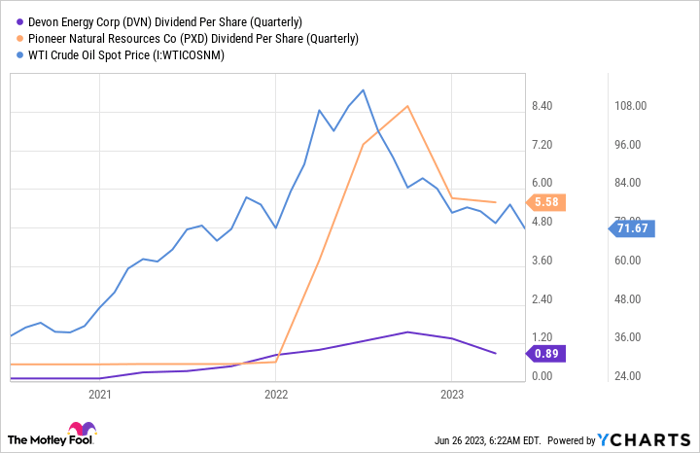

At the other extreme would be a focus on production companies like Pioneer Natural Resources (NYSE: PXD) and Devon Energy (NYSE: DVN). Both of these companies produce oil in the United States, with their top and bottom lines driven almost exclusively by energy prices.

They are inherently volatile businesses, but they have taken a unique approach to returning value to investors by tying their dividends to performance. So when oil prices are high, investors are likely to see huge dividends. When oil prices are low, dividends will be cut.

That’s probably not a great fit for investors looking for consistent dividend stocks. But it does mean that shareholders are likely to be generating more dividend income at the same point in time as they face higher energy costs, for things like gasoline and heating.

Also Read– This Tax Expert Cautions ‘Not All Software Is the Same’

In that way, owning these stocks is kind of a hedge against energy price volatility. That might be a bit more complex than most investors want to get, but for some, it could be a way to deal with real-life cost variables.

Different options with energy stocks

The energy sector is volatile, but you don’t have to avoid it because of that or just accept it, either. There are different ways to deal with it if you understand what you own and cherry-pick your holdings.

The midstream sector is boring and predictable, with many stocks offering generous dividends. Energy majors are big and financially strong, and the best-positioned companies can support growing dividends through good and bad markets.

The results of pure-play energy producers, like Devon and Pioneer, are highly volatile, but these two stocks pay you dividends directly tied to results. That creates a hedging opportunity for the costs you face in your daily life.

If you go in knowing what you want and what you own, you can better control how you benefit from and react to volatile energy prices.

10 stocks we like better than Chevron

Also Read- Want $1 Million in Retirement? Buy and Hold These 5 Stocks

When our analyst team has a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

They just revealed what they believe are the ten best stocks for investors to buy right now… and Chevron wasn’t one of them! That’s right — they think these 10 stocks are even better buys.