In case you haven’t noticed, the bulls are running wild, once again, on Wall Street.

Last year, the mature-business-driven Dow Jones Industrial Average (DJINDICES: ^DJI), benchmark S&P 500 (SNPINDEX: ^GSPC), and growth-stock-fueled Nasdaq Composite (NASDAQINDEX: ^IXIC), all plunged into a bear market — i.e., lost at least 20% of their value.

Also Read– Here’s the pain trade Citi sees in U.S. stocks as S&P 500 exceeds its 2023 target

But since hitting their intraday lows in 2022, the Dow Jones, S&P 500, and Nasdaq Composite have, respectively, bounced by 17%, 22%, and 31%, as of the closing bell on June 5, 2023. Based on the traditional definition of a bull market, which describes a move of 20% or more off of a recent low, the broad-based S&P 500 and Nasdaq Composite are in a new bull market.

While there are number of indicators that suggest a strong start to the year for the S&P 500 or Nasdaq Composite can lead to even bigger gains by years’ end, I’m declaring shenanigans on the new bull market.

Read More:-Oil prices could soar higher as Russia, others shrug off criticism from Biden administration

The new bull market is leaving most companies behind

To be fair, if you’ve been a bear on the broader market in 2023, you’ve been wrong. I certainly put myself in that camp. While I’m an unquestioned long-term bull and have put some of my cash to work in a handful of beaten-down companies this year, I’ve primarily been sitting on an outsized cash position and waiting for the broader market to roll over to deploy it. That bet has, thus far, been wrong.

But do a bit of digging into the dynamics of why the S&P 500 and Nasdaq Composite are higher, and you’ll be far less convinced that we’ve entered a new bull market.

Read More:-The S&P 500 finally broke through a key level. Now what?

As you can see in the tweet above from Michael Kantro, the Chief Marketing Strategist at Piper Sandler, an increasingly smaller percentage of companies are leading the broad-based S&P 500 higher.

Read More:-Stocks slide as debt ceiling vote looms, jobs data stays hot: Stock market news today

Whereas it’s relatively common for between 40% and 50% of the S&P 500’s components to be outperforming the index on a trailing-three-month basis, only around 20% were outperforming in recent weeks. That’s the lowest number of S&P 500 components outperforming the index since March 2000, which is the month the S&P 500 peaked during the dot-com bubble.

Excluding Berkshire Hathaway, the conglomerate headed by billionaire investor Warren Buffett, seven high-growth companies (some of which have more than one class of tradable stock) were primarily responsible for lifting Wall Street higher.

Collectively, Apple, Microsoft, Amazon, Nvidia, Alphabet, Meta Platforms, and Tesla account for 27.39% of the weighting in the S&P 500. These stocks have helped push the benchmark index to an 11.3% year-to-date return.

But on an equal-weighted basis, as opposed to market-cap-weighted basis, the S&P 500 is higher by a meager 1.1% through June 5. Remove the gains from these seven stocks (eight components, including Alphabet’s multiple share-class listings), and the S&P 500 would be lower for the year.

Furthermore, data from Bespoke Investment Group shows that the 10 largest S&P 500 components by market cap gained 8.9% in May, while the “smallest” 490 components fell by an average of 4.3%. This is a market where a select few megacap companies are winning and more and more small-, medium-, and large-cap companies are being left behind.

Also Read- The S&P 500 finally broke through a key level. Now what?

There’s more to worry about than just market breadth

But make no mistake about it: poor market breadth isn’t the only reason I find myself highly skeptical of the 2023 bull market. There are a couple of indicators that stand out like sore thumbs, which have historically not boded well for stocks.

One of the most concerning datasets is what we’re seeing happen with M2 money supply. M2 accounts for everything in M1 (cash, coins, money in checking accounts, and traveler’s checks) and factors in savings accounts, money market funds, and certificates of deposit (CDs) of less than $100,000.

Read More:-Stocks slide as debt ceiling vote looms, jobs data stays hot: Stock market news today

Looking back more than 150 years, M2 has had very few instances where it’s declined. That’s because a steadily growing economy requires more cash to buy goods and services. But among the four previous instances where M2 declined by at least 2%, the U.S. economy endured three depressions (1870s, 1921, and the Great Depression) and one panic (1893). M2 has contracted by 4.8% since July 2022.

While it’s possible this contraction in M2 is nothing more than a reversion to the mean after a historic expansion during the COVID-19 pandemic, shrinking money supply with an above-average inflation rate isn’t usually a good recipe.

To add to the above, I’m not a big fan of what I’m seeing with regard to commercial bank lending. There have only been four instances over the past 50 years where commercial bank loans and leases have fallen by at least 1.5% on a peak-to-trough basis. Three of those previous instances (1975, 2002, and between 2008 and 2010) saw the S&P 500 lose around half of its value. The fourth such instance is ongoing, with bank credit falling 1.64% from its high, as of the latest weekly reading.

A tighter credit market isn’t good news for businesses. Fast-paced companies usually rely on debt-financing solutions to hire, acquire, and innovate. If banks are tightening their lending standards, it’s a potential precursor to economic weakness.

Read More:-How space scientists and artists are preparing for first contact with aliens

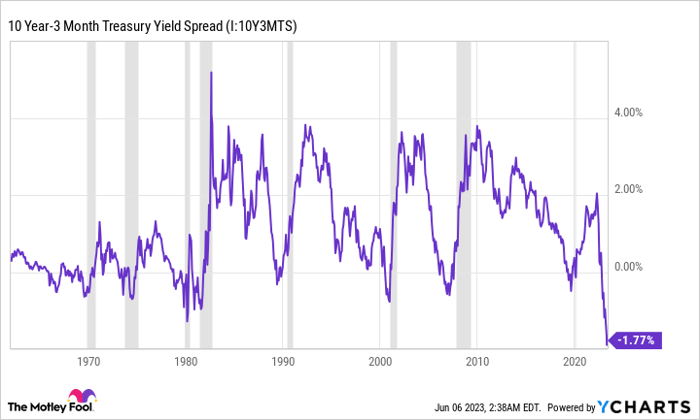

And third, the Federal Reserve Bank of New York’s recession-probability indicator seems to be screaming “recession” at the top of its proverbial lungs. This forecasting tool, which measures the spread (difference in yield) between the three-month and 10-year U.S. Treasury bonds to determine how likely it is that a recession will materialize in the next 12 months, hit a more than 40-year high in May, with a 70.85% chance of a recession.

All three of these indicators point to a growing likelihood of a U.S. recession — and recessions are typically associated with poor stock market performance, at least for a couple of quarters.

Read More:-Limited edition OnePlus 11 5G Marble Odyssey is official

Don’t ignore history, but never forget the power of having time as an ally

Although no metric or indicator can concretely predict the directional movement of stocks 100% of the time, I do find value relying on history as a tool that give those who follow it a potential advantage. It’s these historic trends that have me questioning how much investors should trust the new bull market.

But while history shouldn’t be ignored, there’s, arguably, no more powerful ally on Wall Street than time. Though it can be easy to lose track of this surefire ally when the Dow Jones, S&P 500, and/or Nasdaq Composite are being whipsawed by emotional investors, patience is undefeated on Wall Street.

Read More:-Why Apple, Amazon, & Others Are Banning Employee Use Of Generative AI Like ChatGPT

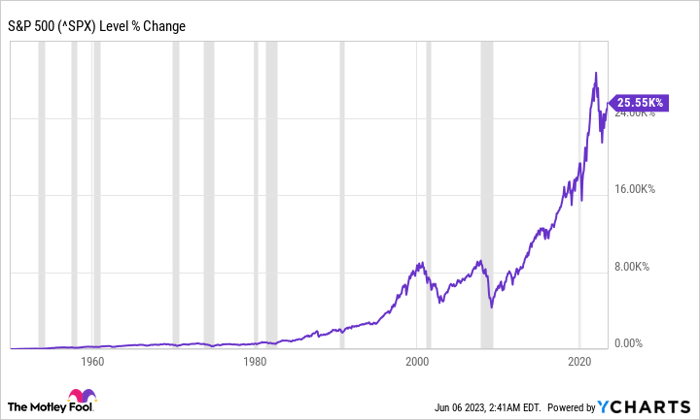

Case in point: the S&P 500 has endured 39 double-digit percentage declines since the start of 1950. On average, that’s a notable drop every 1.88 years. No matter how steep or lengthy these declines were, all 38 previous double-digit drops (excluding the bear market in 2022) were eventually recouped. Pardon the cliché, but time really does heal all wounds, at least for the major indexes.

And it’s not just that the major indexes erase their losses over time. As a whole, the broader market can make patient investors substantially richer.

Read More:-In An Era Of Artificial Intelligence, There’s Always Room For Human Intelligence

One report I’ve highlighted countless times from market analytics company Crestmont Research conclusively demonstrates the power of patience. What Crestmont did was examine what an investor would have generated in annualized total returns, including dividends, if they’d, hypothetically, purchased an S&P 500 tracking index and held that position for 20 years.

The interesting thing about Crestmont’s analysis is it was able to backdate its dataset to 1900. Although the S&P 500 didn’t exist at the start of the 20th century, its components were very similar to the Dow and other major indexes, which made back-testing a possibility. Doing so created 104 ending years (1919-2022) of data.

Read More:-The 4-day workweek is gaining momentum. Could the US adopt it nationwide?

Every single 20-year rolling timeline led to a positive total return for this hypothetical investor. In other words, it hasn’t mattered when you’ve put your money to work in the S&P 500 for more than a century, so long as you remained invested and trusted your investment thesis for 20 years.

While I’m, perhaps, stubbornly waiting on history to give me perceived-to-be attractive entry points on a number of current holdings and prospective buys, I’m steadfastly holding close to four dozen stocks over the long run that I believe can grow over time and deliver sizable returns.

Read More:-How Trump can get away with saying he was lying about Iran doc

Don’t ignore history, but trust in time as an ally.