With a $30 billion market cap, it isn’t too surprising to find industrial stock Fastenal (NASDAQ: FAST) in the S&P 500 index, even though it probably isn’t a household name. But given its impressive dividend growth record, it should be a top-of-mind option for income-oriented investors.

Here’s why now is a pretty good time to consider adding this vital supplier to your portfolio.

Bits and pieces

At its core, Fastenal sells little things that get used a lot by its industrial customers. The list is fairly wide, ranging from, as its name suggests, fasteners to tools. From this perspective, the company is pretty boring and easy to understand. But on top of this, management has layered a high-tech business model that turned Fastenal from a parts supplier into a vital partner.

Read More:-Your Daily FinanceScope for May 14, 2023

Essentially, the company has been shifting from selling products through a store network to operating within its customers’ businesses. That includes a variety of systems, like vending machines, that are digitally connected. This allows Fastenal and its customers to see what parts are being used, when, and by whom. Inventory is better managed and updated and workflows can be improved using a team approach. It’s a win-win, noting that Fastenal becomes increasingly difficult to replace the further it gets integrated into a company’s processes.

The numbers here are notable. In 2017, Fastenal had 2,383 stores and 605 “onsite” locations, which is what it calls an operation within a customer’s business. At the end of the first quarter of 2023, it had 1,660 stores and 1,674 onsites. Notably, its total locations increased from 2,988 to 3,334 over that span. And, over the last five years, the company’s revenue increased at an annualized rate of roughly 10% with earnings per share expanding at a clip of around 13%. So not only is it executing its strategic shift, but it is growing its business while it is doing it.

Read More : 10 Best Apps To Manage All Your Finances and Keep Track of What You Have

What a run

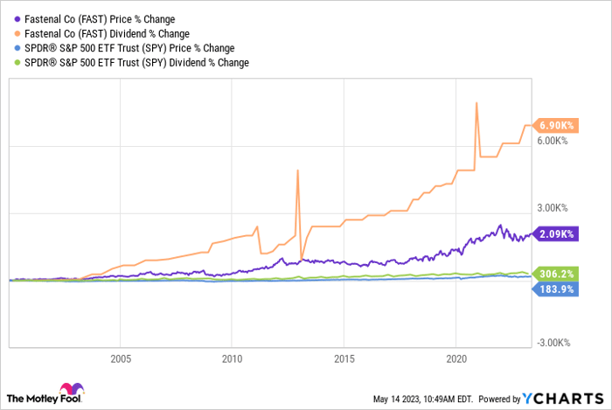

With execution like that, it shouldn’t be shocking to learn that Fastenal has increased its dividend annually for 24 consecutive years. And, even more important for dividend growth investors, it has done so at a fairly rapid clip, noting that the average annualized increase over the past decade was a generous 14%. The most recent increase, made in January, was roughly 13%. So while dividend increases will ebb and flow over time, 14% is not a historical artifact that is out of reach in the future.

During Fastenal’s first-quarter 2023 earnings conference call, management made a point of highlighting that it is seeing some weakness in its end markets. And that the economy isn’t something that the company can control, with management preferring to focus on things like investing for long-term business expansion and rewarding investors with dividend growth. That’s exactly what you want to hear, especially given the success that has been achieved to date.

Read More:– A local’s guide to Cape Town, from new hotel openings to edgy art galleries

Adding to the allure of the dividend is an incredibly strong balance sheet, with a debt-to-equity ratio of 0.12 times. That’s incredibly low and suggests that there’s room for acquisitions and capital investment plans, and still ample room for adversity before the dividend would be at risk. The company also covers its trailing-12-month interest expenses by roughly 100 times, which is an astoundingly strong number. So while the dividend payout ratio has historically trended between 60% and 75%, that is completely reasonable given the company’s broader financial strength.

Also Read– Rural & Remote: 10 Most Beautiful Towns In Western Australia

The one problem

The thing with Fastenal is that Wall Street is wise to its long-term success so the stock is rarely cheap. But today the dividend yield of roughly 2.5% is toward the higher side of the historical yield range. It probably wouldn’t be fair to call the stock cheap, but it does seem like it is fairly priced (that’s backed up by the fact that the price-to-sales and price-to-earnings ratios are both in line with their five-year averages). Value investors might prefer to wait until the yield is up toward 3%, which happens from time to time, but long-term dividend growth investors shouldn’t pass up the opportunity to buy a great dividend growth company at a reasonable price without at least doing a deep dive.