The technology sector has a history of outperforming the rest of the stock market. Over the last five years — amid the pandemic, supply chain issues, war in Europe, and a weak economy — the Nasdaq-100 tech index has delivered a total return of 90%. That’s significantly better than the 51% return of the broader S&P 500 index.

Read More:– US small business optimism deteriorates in April, NFIB says

But those stronger gains come with greater volatility, and as a result, it’s not unusual to see individual technology stocks decline by 50% (or more). Not even the giants of the industry are immune; Tesla (NASDAQ: TSLA), Amazon (NASDAQ: AMZN), and Meta Platforms (NASDAQ: META) have all lost more than half their value at various points in time over the last 18 months.

One stock that still trades 75% below its all-time high is Confluent (NASDAQ: CFLT). The company is growing quickly, and it just reported strong results for the first quarter of 2023, so here’s why investors will want to buy the stock while it’s down.

Data streaming will eventually be used everywhere

Consumers have grown accustomed to a high level of convenience in their digital experiences. When they visit an online store, it’s no longer acceptable for inventory information to be out of date — if the website says a product is in stock, it has to be in stock. Similarly, businesses are drawing more benefits from knowing real-time information than ever before, especially when it comes to crafting new strategies.

That’s where Confluent’s data-streaming technology comes in. Companies are harvesting more information than ever before, and Confluent allows them to receive, analyze, and make key decisions from it instantly. It’s a leap forward because data used to be warehoused for analysis at a later date, which meant the insights learned might not be relevant by the time they’re drawn.

Read More:– Stock market today: Global shares decline ahead of reports

Take Walmart (NYSE: WMT), for example, which uses Confluent for inventory management. It connects all of its physical and online stores, so every time a sale is made, that product is immediately replenished before it runs out of stock. That means customers know they can walk into any Walmart location across the U.S. and find exactly what they’re looking for. If inventories were only taken once a week or once a month, thousands of sales could be lost to empty shelves.

Data streaming also has consumer-facing applications. Sports betting platforms, for example, use Confluent to feed odds to punters during live games. These markets can change hundreds of times during an event, so the bookmaker needs to calculate the odds, send them to the customer’s mobile application, and accept bets in a matter of seconds before the probabilities shift again.

According to the International Data Corporation, 90% of the world’s largest companies will use similar event and data streaming technology by 2025.

Read More:– Small Business Owners Embrace Managed IT Services for Cybersecurity Confidence

Confluent delivered another strong quarter in Q1

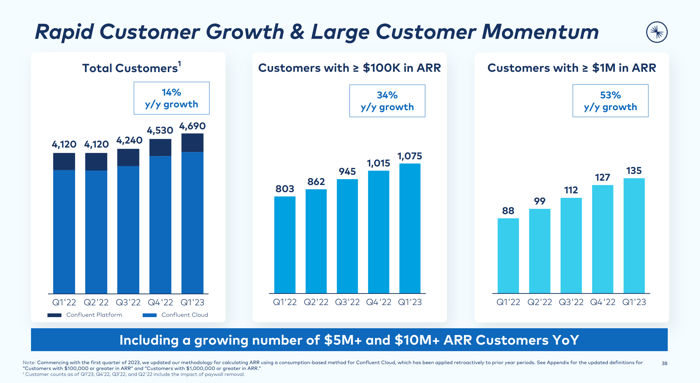

The company generated $174.3 million in revenue, which was up 38% year over year and well above its $168 million forecast. Much of that growth was driven by the adoption of Confluent’s technology by large organizations with significant budgets.

The businesses contributing higher amounts of annual recurring revenue (ARR) to Confluent appear to be flocking to the platform at a faster pace than the average customer.

Read More:- Why Fisker Stock Leaped Nearly 7% Higher Today

The company says its platform is incredibly sticky even in this tough economic climate because businesses are placing data streaming at the core of their operations and investing significant amounts of money to do so. That notion is confirmed by Confluent’s net revenue retention rate of 130%, which means existing customers are spending 30% more on the platform than they were at the same point last year.

Read More:– Small Business Owners Embrace Managed IT Services for Cybersecurity Confidence

One area Confluent disappointed, though, was its bottom line. The company is still scaling up, so it’s investing heavily in growth; its operating expenses grew by 47% year over year in Q1, which was a faster pace than its revenue growth. As a result, it made a quarterly net loss of $152 million. Even after stripping out one-off and non-cash costs (from acquisitions and stock-based compensation), Confluent still lost $25 million on a non-GAAP (adjusted) basis.

But here’s why Confluent stock is really a buy now

The company has a very strong balance sheet, with over $1.8 billion in cash, equivalents, and marketable securities that can support its losses for a few more years during this growth phase.

Continuing to invest in customer acquisition is key because Confluent is chasing an addressable market worth an estimated $60 billion right now, and the company expects that to grow to $100 billion by 2025. Plus, as mentioned above, its high net retention rate means each customer who signs up becomes about 30% more valuable with each passing year, so getting them in the door quickly could supercharge future revenue growth.

The 75% decline in Confluent stock certainly hasn’t deterred the professionals on Wall Street. The Wall Street Journal tracks 22 analysts covering the stock, and 14 of them have given it the highest-possible buy rating. One is in the overweight (bullish) camp, while seven recommend holding. Not a single analyst recommends selling.

Read More:- Why Fisker Stock Leaped Nearly 7% Higher Today

Confluent continues to reach business goals and grow quickly, so investors might want to follow Wall Street’s lead and buy the dip in its stock for the long-term.