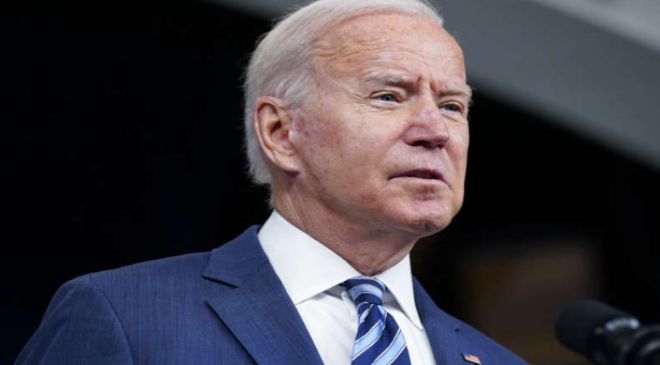

President Joe Biden’s order to cancel student loan debt for millions of Americans will cost an average of $30 billion per year over the next decade and $379 billion over the course of the program, according to a Biden administration cost estimate.

The administration analysis of the overall cost roughly lined up with a Congressional Budget Office economic analysis released this week that put the cost of the program, which would take into account loan repayments over the course of 30 years, at roughly $400 billion. But administration officials continue to argue the best method to estimate costs would be the amount of reduced cashflow to the federal government due to the action. The administration analysis using this method found that would cost roughly $305 billion over a decade.

The CBO analysis sparked an intense new round in the weeks-long battle between the White House and congressional Republicans over the size of the action. White House officials have steadfastly defended the merits of the proposal, which is structured in a way that would direct nearly 90% of the debt relief to individuals earning less than $75,000 per year.

“Every dollar that we are going to record as a cost to the federal government is actually a benefit to a low- and moderate-income families,” a senior administration official said. “We talk about costs to the federal government, but what they actually are is the fact that millions of people will be able have a little more breathing room in their lives every year.”

Biden’s decision to sign off on a targeted student loan forgiveness program came after months of intense debate inside the White House over the scale, cost, legality and merit of the proposal – a debate that drove the action to be targeted to lower- and middle-income borrowers and direct even more assistance to federal Pell grant recipients. White House officials expected blowback to the proposal, both in the form of legal challenges and attacks over what was would be a significant overall price tag.

Read More : Porsche celebrates Europe’s largest IPO in over a decade as Volkswagen prepares charge at Tesla

The cost estimates come the same day the Biden administration took its first steps to kick off the forgiveness process, detailing the next steps for borrowers covered by Biden’s decision to cancel up to $10,000 in student loan debt for individuals making less than $125,000 a year or as much as $20,000 for eligible borrowers who are also Pell grant recipients. The window is expected to open for borrowers to apply in the coming weeks.

But the process is still a work in progress, with the Biden administration moving this week to scale back eligibility for the plan.

Borrowers whose federal student loans are guaranteed by the government but held by private lenders will now be excluded from receiving debt relief. Around 770,000 people will be affected by the change, according to an administration official.

The Department of Education initially said these loans, many of which were made under the former Federal Family Education Loan program and Federal Perkins Loan program, would be eligible for the one-time forgiveness action as long as the borrower consolidated his or her debt into the federal direct loan program.

The legal and price tag objections from Republicans have been thrust to the forefront this week, with two legal challenges filed and the fierce blowback to the CBO score. The legal challenges included an effort by six Republican-led states to sue the administration to overturn the action.

Sen. Richard Burr, a North Carolina Republican, called the overall price tag “a cost that will be borne by working Americans who chose not to go to college or who responsibly paid off their loans.”

“Every American should be outraged by the President’s cynical ploy and by the real cost it places on those who stand to benefit the least,” Burr said in a statement after the release of the CBO estimate.

White House officials have pushed back on the cost, noting the targeted nature of the benefit as well as the levels of deficit reduction that have been attributed to or projected for the administration over Biden’s first two years in office.

“Within that context, the view of the President was that we could take this action intended to benefit low and middle income families and do it in a fiscally responsible way,” a second senior administration official said.

Administration officials, like the CBO, underscored the high degree of uncertainty behind modeling cost estimates for a program tied tightly to the number of borrowers who use it and the underlying economic conditions in the years ahead.

“These estimates are inherently very uncertain,” the official said. “They rely on a ton of different assumptions, that’s true of our estimate, that’s true of the CBO estimate.”

The administration’s cost estimates, conducted over the course of the last several weeks by the Office of Management and Budget and the Department of Education, mark the most fulsome administration analysis into Biden’s decision last month to take the action that could provide student loan relief for as many as 40 million borrowers. The estimates did not include the cost of Biden’s decision to temporarily extend the freeze on federal loan payments to the end of the year, or the administration’s actions on income-driven repayment plans.

The Biden administration’s overall cost estimate lands roughly in the same ballpark as the CBO estimate, with differences between the two driven by a number of variables including uncertainty regarding economic forecasts and a different threshold for how many borrowers would utilize Biden’s program.

The administration’s cost estimate of an average of $30 billion per year over the next decade is part of an analysis of the reduction in cash flows into the government, which administration officials have pushed as a more accurate way to estimate the near-term effect of the overall cost to the government by the action.

The debate over the best way to estimate the cost of student loan debt cancellation is long running, and centers on the methodology for cost estimates of credit programs. Biden’s action, based on how programs are scored, would immediately eliminate roughly $379 billion in federal assets. But White House officials have argued that it doesn’t reflect the reality of a portfolio of loans expected to be repaid over decades.