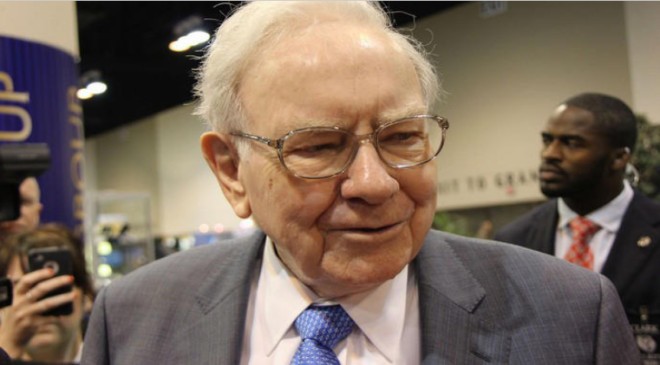

When the markets get dicey, you could do a lot worse than follow the moves of the greatest investor of all time. Warren Buffett’s investments in stocks and private businesses through Berkshire Hathaway have created tremendous wealth for shareholders. A $1,000 investment in the stock in 1965, when Buffett took control of the once-struggling textile manufacturer, would have been worth $36 million at the end of 2021.

At the end of March, Berkshire held a stock portfolio worth $390 billion. Keep in mind that some of the smaller positions in the portfolio, such as RH (NYSE: RH), were likely chosen by Buffett’s investing deputies, Ted Weschler and Todd Combs. In Buffett’s 2021 shareholder letter, he noted that Weschler and Combs had control over $34 billion of Berkshire’s investments at year-end. The larger positions, including the most recent addition, HP (NYSE: HPQ), are typically from Buffett himself.

As it turns out, the two stocks with the shortest names on the list also happen to be among the cheapest stocks in Berkshire’s portfolio. Here’s why these two stocks are worth considering.

1. RH

Share prices of the luxury furniture brand, formerly known as Restoration Hardware, are down 65% from their all-time high, and Berkshire Hathaway was taking advantage of the lower price by adding shares to its position in the first quarter. As of March 31, Berkshire held 2.17 million shares worth $707 million.

The small position size likely suggests Weschler or Combs bought the stock on Berkshire’s behalf. Regardless, RH fits the type of well-managed business Berkshire typically looks for with its private business transactions, such as Buffett’s decision to acquire Nebraska Furniture Mart in 1983.

RH has been very successful following a strategy of opening luxurious galleries in large metropolitan areas. It just recently opened RH San Francisco at the historic Bethlehem Steel Building. Over the last decade, total revenue has more than tripled to $3.7 billion, and management sees a long runway for growth. As the company expands globally, management expects annual revenue to climb toward $20 billion to $25 billion.

Obviously, the market is worried about the impact on consumer spending in the near term from surging inflation. However, RH generates a high operating profit margin of 25%, and it’s been increasing in recent years. This partly reflects the exclusive nature of its products and services, and the premium pricing it commands.

But the stock sells for an incredibly cheap price-to-earnings (P/E) ratio of 10.5. Note that the average company included in the S&P 500 index has historically traded around 16 times earnings and that the current S&P 500 P/E ratio is 29.9. That discrepancy accounts for numerous economic cycles over the last century, which is why when a business with above-average growth prospects is selling this cheap, it can be a signal of undervaluation. Berkshire’s investing gurus clearly believe the market is undervaluing RH’s long-term prospects.

2. HP

Berkshire disclosed a new stake in HP (formerly known as Hewlett-Packard) worth $3.8 billion at the end of the first quarter. HP benefited from the pandemic-driven demand for PCs and other remote work essentials. But Wall Street hasn’t awarded the stock a higher valuation. The shares currently fetch a low (P/E) multiple of 8.4 based on this year’s full-year earnings estimates.

Wall Street views HP’s reliance on growing demand for PCs and its legacy printing business as an Achilles’ heel. The printing segment made up 32% of HP’s total revenue in fiscal 2021 (which ended Oct. 31). Printing revenue grew 1% year over year in the most recent quarter. Over the long term, the bears argue that HP may have trouble expanding due to the growing use of mobile phones and digital documents in the workplace.

However, the reasons Buffett likes the stock, other than the rock-bottom valuation, may be related to HP’s stable revenue stream, improving operating margin, and management’s capital allocation. The latter is something Buffett values highly in a company.

To counter the headwinds to growth in legacy products like printers and ink cartridges, management has been smart to shift investment to more attractive markets, such as premium PCs built for video game enthusiasts, video conferencing, and retail point-of-sale systems. In printing, HP is investing in 3D printing solutions and subscription services. The HP Smart app has 50 million monthly active users, while the Instant Ink subscription business is growing rapidly.

What’s more, HP has been aggressive in repurchasing its own stock. HP’s diluted shares outstanding have decreased by 28% in the last five years. Buffett has applauded Apple, Berkshire’s largest equity holding, for its share-repurchase program. The reduction of the share count has the effect of boosting each shareholder’s percentage ownership of the company and therefore, boosting shareholder returns over time.

HP stock has outperformed the S&P 500 index year to date, down 4.5% compared to a drop of 15.4% for the index. That might be a sign the Oracle of Omaha is on to something. HP’s capital allocation toward faster-growing markets and its shareholder-friendly capital returns could make the stock a compelling value in this bear market.